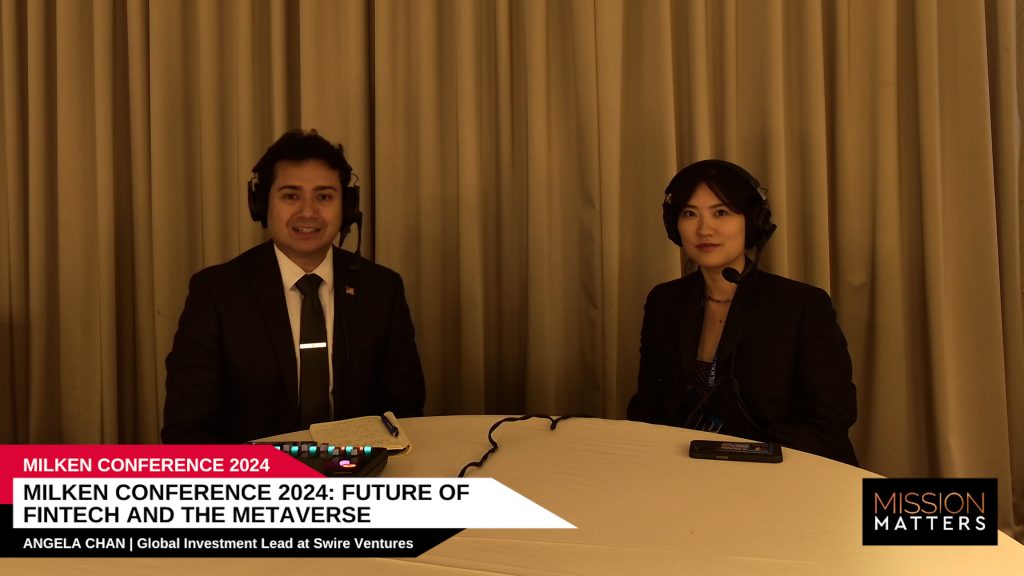

Adam Torres and Angela Chan discuss Swire Ventures.

Subscribe: iTunes / Spotify / Stitcher / RSS

Apply to be a guest on our podcast here

Show Notes:

In this episode, Adam Torres and and Angela Chan, Global Investment Lead at Swire Ventures, explore Swire Ventures and the Milken Conference.

Watch Full Interview:

About Angela Chan

Angela Chan works as a Global Investment Lead at Swire Properties, which is a Real Estate company with an estimated 5,600 employees. They are partof Finance Department and their management level is Non-Manager. Angela is currently based in Central and Western.

Full Unedited Transcript

Hey, I’d like to welcome you to another episode of Mission Matters. My name is Adam Torres and I’m proud to announce that I’m at the Milken Global Conference 2024 in Beverly Hills, California, and my guest today is Angela Chan, who I snagged on the last day. Angela, I’ve been trying to get this interview with you.

It’s so fun to have you on the show. Thank you for having me. All right. So we got a lot to talk about. So we’re Swire ventures. I understand you’re leading their, their efforts there with a fund. I want to know a little bit about maybe the Swire art committee. I know that’s a little side, but I want to know, like I was part of the century city art committee here in century cities, right next to Beverly Hills for those in this audience that don’t know but it’s pretty close.

So I was like, Oh, what’s going on over at Swire. And I guess just to kick get this kicked off we’re heading End of the conference. What, so many memories, so many things. What was your favorite part of the conference? Let’s start there. It’s been overwhelming. Yes. There’s some really good sessions, obviously.

So back in was here, I think Bill Clinton’s about to speak as well. We’re having those interview. But I think, I mean, the quality of the speakers and guests is just quite next level. I have to travel quite a lot for conferences globally. And I think Milken really, it’s like. Streets beyond any other conversations that I’ve been to because then by only as you know and so I think the best part is not any one session, but the organic conversations that you get to have with the people around you.

I was at lunch the other day and I sat, I was wearing this funky jacket and the guy next to me commented and complimented my jacket. He turned out to be the founder and president of forever 21 and now we’re great buds. You know, how cool is that? So. So yeah, so the, the organic interaction that I’ve had with the people around has just been phenomenal.

And that’s what happens at Milk. And I always tell people, I’m like, you got to come. So I went to my first conference about nine years ago now, and this is my second year covering it as media. And I, this is my Super Bowl. I come every year. I can’t wait. I’m like, let’s go. What, what’s next? And because there’s always just new people, new conversations, and, and, and, and, and I think for the, like, just that hotspot of all to get to all the people that are here in a regular calendar year or otherwise, impossible.

What would it have taken you to have a conversation with the CEO, for example, of Forever 21? I mean, busy people, right? But you get them here. It’s like a captive audience. And he’s in LA. He’s been in LA for 30 years. How else would I have gone to meet him? So. So I noticed when I was looking at your LinkedIn profile, I saw that there was this milking young leader circle.

I wasn’t even aware that this was So enlighten me. Right. So it is I believe it isn’t by only, but I mean, it’s a bunch, it’s like a group of 250 young people, younger people that’s aged 25 to 40 across industries, leaders in their industries. And there are chapters around the world. So I think it started in LA, I believe.

And then there’s, you know, New York chapter, London chapter. Singapore chapter. And now they’re starting and launching like a Hong Kong, China chapter. Yeah. So it’s a great group of people. It’s kind of like the white, you know, like a YPO young shapers thing. Yeah. So what do you do? Like, what do you do?

Yeah. So we have a WhatsApp group and then, well, that’s where it doesn’t everything start in a WhatsApp group. First of all, I mean, it’s localized as well. Right. So it has to have a real group. Is that? No, for sure. For sure. And all the spans that come along with it. But no, I love it. It’s their local events depending on the chapter.

So right here at, you know, this year’s milk in their side events and drinks and parties. And so it’s a lot of, it’s more networking. But in the group, people are super responsive and helpful. So even if you ask, you know, Especially if you ask like any random specific question, like anyone has a hookup to CEO of XYZ or, or like, does anyone know about this ridiculously niche vertical, like someone’s bound to have an answer for you or they could, they’re more than happy to thank you to the person that has the answers.

So I think it’s, it’s, it’s a great community. Let’s jump Swire Ventures, like what, like what brings you there? I know that you’re a global investment lead there and you’re working on a fun light. Like, tell me more. So so Swire for those who don’t know it is a global conglomerate. So we own Cathay Pacific, the airline Coca Cola bottler and distribution in Asia.

And we’re one of the biggest premium developers in Asia. So in Hong Kong, China, and in Miami, which is quite random. So for those in the States the whole Brickell area. And in Miami and East Hotel and we’re also building quite aggressively in Miami. So we’re in a JV with Mandarin Oriental.

We’re building out the Mandarin Oriental residences for anyone who has any extra cash lying around. They’re for sale soon. And so. Yeah. So we’re across mixed use residential, luxury malls, hotels, office so quite a broad or broad portfolio. So this fund is, it’s quite a young fund, it’s pure balance sheet money.

So corporate VC fund, it was started three, four years ago. So I joined about three years ago and it’s a early stage tech fund. Yeah. So we invest into early a series A to C. tech startups in verticals that are relevant to us. So it, this means construction tech, because we’re still building out a lot. So construction robotics software.

And the second vertical is retail, retail tech. Cause we have a lot of luxury malls. And we’re the, the The first partner that brought in luxury groups like LVMX and caring and response into Asia. And so retail tech would mean, you know, instore analytics, omnichannel stuff eComm, and so it’s a broad, broad space for us.

And then the third one is ESG and sustainability. So that one is a exciting one for us. So anything from. Carbon accounting, carbon tracking you know, decarbonizing the built world is obviously very important and real estate and especially is, is huge, you know, for As old economies go, it’s a big one that needs to be digitized and decarbonized.

So, I mean, there’s some cool stuff they will look at, you know net zero concrete, cement 3D design for architecture I mean, AI design, excuse me and generative AI used in design and things. And so. That’s quite a broad mandate. So when you come to a conference like this, are you looking for you know, companies, ideas to invest in, investors, like, like, why come to a conference like Milken?

Yeah. So we don’t need to fundraise cause it’s balance sheet money but I think we’re always on the lookout for good, good startups and to maintain and to get to know more good funds from a dealable Deal flow sharing perspective from like thought leadership perspective. It’s just great to have that network.

The man, I mean, the fund is, is global, so we invest in us and Europe and as well as Hong Kong, China. And so, I mean, knowledge I think is, is transferable, right? It’s wherever the politics lands. Like, I think there’s so much value to, to learn from, you know, what’s the latest in terms of the different tech verticals and your us and Europe.

And so for Milken You know, I throughout see or through just just general audience, you know, it’s a hearing from thought leaders in their industries speakers, what are their, you know, perspectives and insights not just from a macro level, but obviously on the more Casual like side conversations.

I get to get a, get a sense of what, you know, people are thinking. And and also obviously maintaining those relationships after Milliken. So I think that’s important for us from, again, you know, for potential co investments any. Companies that we could help with coming to Asia and also vice versa.

You know, any of our portfolio companies that are looking to expand abroad. So pretty wide investment mandate. So based off of this, I’d have to assume in all, in your travel, your travel schedule, all the conferences you go to, and otherwise, like you have a unique vantage point, like you’re seeing what’s next.

You’re seeing trends. You’re seeing a lot of ideas. In general, what excites you right now? What excites you? Wow. That’s a very. I know there’s a lot. I know. Yeah. So there’s so much hype out there. Right. So two years ago it was metaverse. Yeah. Was it, I forget. There you go. Yeah. Or NFT or something. It might be three.

It could depend on the month. Right. Right. I mean, now I guess it’s back this year. And I mean the buzzword for this year is Adrenaline AI. I think what excites me is not so much how far the tech is going or how, when, right, like how. Advance the tech is going, but rather for all these cool tech that we’re developing, what are the use cases?

Like bringing it back down to earth, you know? So for instance, for us, like as like low hanging fruit as appraising, you know, doing appraisals for, for our real estate portfolios, not just as a developer, but let’s say, you know, firms like Blackstone. For deal, doing deals, appraising real estate deals, a lot of them, like the biggest developers in the world are still doing Excel, but it’s, it’s ridiculous.

Right. So, so using, so you don’t even need to do like, Oh, text, image, you know digitization is real. Like that’s a thing. It’s real. It’s hard to change. Exactly. I mean, I think it’s really cool to, you know, play around with the chat GPT and all the modalities that are available right now. Again, bringing it down to use cases on an enterprise level.

I think it’s, it’s the mentality shift that I’m looking forward to, that we can actually apply some of this cool tech in a very concrete way. Digitizing the company. Yeah. And if you’re out there watching and you’re like, Oh, spreadsheets. I have a couple of spreadsheets too. So I’m guilty too. It’s okay.

One day we’ll all be off. It does the job. One day. I mean. Jumping around just a little bit here, Angela. I saw Swire art committee, like talk to me, like what your interest in art. Yeah. So I love art and design. I grew up with art. And so Swire is a brand that’s been very good at placemaking.

Our, a lot of our properties are Truly cultural landmarks in Hong Kong and China. I grew up going to them. So I’m not, I’m not really like drinking the Kool Aid after I joined. How amazing is that to then join the company and then be part of seeing what it takes to like maintain that brand. Truly, truly.

And and again, cause I love design and architecture and things. I really would argue that Swire has been really good at you know, working with amazing architects with our properties, our hotels really kind of putting these hotels and properties on the global map. And so the art committee is really set up it’s very casual unofficial committee.

Those are the most fun ones though. I don’t care, especially at financial firms. It’s like, wait a minute. That’s the best. Yeah. Those are the best. With fantastic people. Yeah. So that’s really set up to, to help us kind of work with whether internally or external consultants on deciding kind of which art pieces sculptures and things to acquire and to put in our malls our hotels and rotating, you know, putting them on rotations.

We’ll have a roster of those things. And we sponsor the Art Basel every year in Hong Kong. And so there’s art month that we do like in March and we, we bring in some fantastic global artists, you know, doing shows at our properties and, and really activating our real estate in, in creative ways.

And so I think we’re, we’re quite plugged in and we’re very cool sponsor of the art scene in Hong Kong and Asia. And I, I’m very honored to be a part of that. Amazing. Final question. 2024 we’re in May. What are you looking forward to for the rest of the year? Like, give me, give me some updates. What’s next?

Yeah. Well there’s milk and Abu Dhabi and Singapore, I think. Are you going to that? Q4. Oh, I don’t know. Oh my gosh. That’s why I was like, yeah, we’re sending you. Okay. Got it. That’s Q4. Yeah. Yeah, I mean, I think for, for venture, it really is an exciting time. This year it’s bouncing back last year.

A lot of funds are not really deploying and I think it’s a good time because as you know, in, in investments or especially in venture, it really, it’s cyclical. So right there for the past few years, such a bull market that we call them PowerPoint companies, a lot of companies, barely an idea of key revenue, even pre product were able to raise a lot of money.

And those terms were very Founder friendly now, I would say it’s swinging to more investor friendly environment, I think for, for good reasons. And I think it’s a good thing. Right. So, so I think it’s it’s an exciting time to see kind of when the tide recedes and the, you know, the, the, the ones who stay and the ones who survive and go companies will always.

Be able to survive and thrive. So I’m excited to, to get to know more about, you know, I mean, to hear more and to get to know more good founders and to back the, the ones that we have conviction in. All right. Wonderful. Well I want you to look into the camera, tell people how they can learn more about Swire, how they can follow you, whatever else call to action you like there, how do people learn more?

Right we have a website, so if you just type in Swire New Ventures, you’ll see it. And I’m on LinkedIn, and I’m quite responsive, so ping me anytime. Amazing. And to the audience this is our final interview for the week. I can’t believe we made it through Milken again. What a day. I’m walking through the hall and everybody is like, okay, we’re done.

Yeah. I’m like, wow. That person had a long way. It’s everybody. Yeah. Pockets are bulging from cards. I don’t know. Like they just ate lunch. It’s all good. Well, Angela, I just want to say, Hey, thank you for coming on this show is a pleasure to meet you. Thank you so much, Adam. so much for having me. My pleasure.